Technology & Execution

Advanced Trading Infrastructure for Optimal Liquidity & Performance

At Hub LP, we leverage cutting-edge trading technology, institutional-grade execution, and deep liquidity aggregation to ensure brokers, hedge funds, and financial institutions receive the highest level of performance. Our solutions are designed to maximize execution speed, minimize slippage, and enhance trading efficiency for all market participants.

Hub LP

Institutional-Grade Trading Infrastructure

Our proprietary technology stack is built to handle high-frequency trading, large volumes, and rapid market fluctuations without compromising on execution quality.

Ultra-Low Latency Execution

Orders are processed in milliseconds for the fastest market access.

FIX API Connectivity

Direct integration with institutional liquidity providers.

Smart Order Routing (SOR)

Ensures optimal trade execution with minimal slippage.

Aggregated Liquidity

Deep liquidity sourced from Tier-1 banks, hedge funds, and prime brokers.

Multi-Platform Compatibility

Seamless connectivity with MT5, and other trading platforms.

Scalable Infrastructure

Designed to support brokers of all sizes, from startups to global institutions.

Hub LP

FIX API Connectivity – Seamless & Ultra-Fast

Hub LP provides FIX API integration, delivering direct market access, high-speed execution, and deep liquidity connectivity for institutional traders and brokers.

Key Benefits of Our FIX API

Ultra-Low Latency – Millisecond-level trade execution for high-frequency trading.

Customizable Liquidity Feeds – Tailored spreads, execution models, and order flow.

Direct Access to Liquidity Pools – No intermediaries, pure institutional-grade execution.

Scalability – Supports high-volume trading and complex strategies.

24/5 Technical Support – Dedicated API specialists for seamless integration.

Security

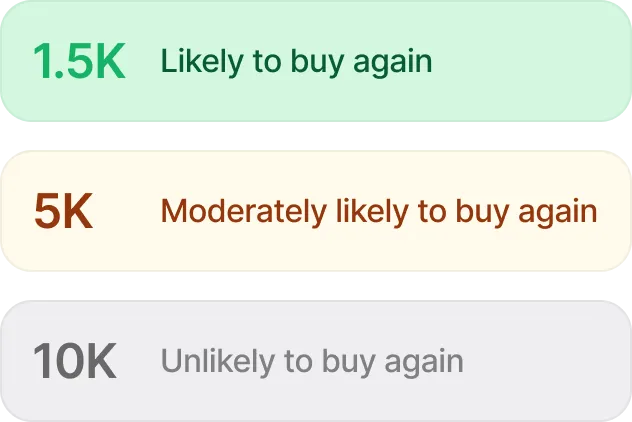

Liquidity Aggregation – Deep, Multi-Tiered Pools

Our proprietary liquidity aggregation technology sources liquidity from multiple Tier-1 banks, financial institutions, and non-bank liquidity providers, ensuring the tightest spreads and best execution prices.

How Our Liquidity Aggregation Works

Multi-Source Liquidity: Orders are executed through the most competitive pricing streams.

Best Bid/Ask Matching: Ensures superior pricing across all trading instruments.

Customizable Spreads & Execution Models: Designed to meet broker-specific requirements.

Minimal Slippage: Deep order book ensures orders are filled efficiently.

Risk Management & Execution Models

Available Execution Models

At Hub LP, we offer advanced risk management tools and execution models to help brokers optimize order flow and mitigate exposure.

STP

ECN

Hybrid A/B Book Models

STP (Straight Through Processing)

Direct trade execution with no dealing desk intervention.

ECN (Electronic Communication Network)

Deep liquidity with true market execution.

Hybrid A/B Book Models

Customizable risk management strategies to balance profitability and risk.

Multi-Platform Compatibility & Bridge Integration

Our liquidity solutions integrate seamlessly with all major trading platforms, providing brokers with smooth order execution, minimal downtime, and maximum efficiency.

Compatible Trading Platforms:

MT5 – Full integration for forex brokers and prop firms.

FIX API – Direct institutional-grade liquidity access.

Custom Trading Platforms – Compatible with proprietary trading systems.

Security, Stability & 24/5 Support

We understand the importance of security, uptime, and ongoing support in liquidity provisioning. Hub LP provides

99.99% System Uptime – Ensuring uninterrupted trading operations.

Redundant Servers & Data Centers – Global infrastructure for maximum stability.

Dedicated Account Managers – Personalized service and expert guidance.

24/5 Technical Support – Available for troubleshooting and assistance.